Peer-to-peer fraud, or P2P fraud, is when thieves utilize peer-to-peer payment systems to steal money from legitimate users. They accomplish this through various methods, including overpayment frauds and the theft of login information (using strategies like phishing assaults).

P2P payment fraud takes advantage of the near real-time nature of payments made using P2P apps, such as PayPal, Google Pay, Cash App, Venmo, and Zelle. This implies that money may instantly travel the world through the Internet. Fraudsters have an opportunity since they can swiftly access their victims’ money.

As a result of the enormous market that fraudsters might exploit, customers and companies who utilize P2P payment technologies need to stay up to date on the most recent threats.

P2P Fraud: How Does It Operate?

P2P fraud may take many forms, so companies and consumers must be on the lookout. Obtaining money from the authorized user’s account and into the fraudster’s account is the identical objective behind all P2P fraud, notwithstanding this. Fraudsters do this via various strategies, including physical theft and social engineering.

The instantaneous nature of P2P transfers is one reason fraudsters try to do it frequently since it works so effectively. The fraudster gains as soon as the transaction is completed. Since many P2P payment applications emphasize how simple it is to send money—often only requiring one or two clicks or taps—fraudsters have plenty of opportunity to exploit this ease of use and quickly line their virtual pockets with dollars belonging to real users.

P2P Scams and P2P Fraud: Differences

Although they are sometimes used interchangeably, the two names differ slightly. In contrast to P2P fraud, which includes transactions without the account holder’s awareness, P2P scams typically entail some deception.

Let’s think about a few instances. In the above-discussed overpaying and selling scams, con artists deceive victims into engaging in transactions. These factors make them P2P scams: The actual account holder is the one who makes the payment.

P2P fraud, on the other hand, involves the fraudster exploiting the victim’s account to make payments. The victim is unaware of the payment(s) until after the event.

P2P Fraud’s Impact on Businesses

P2P payment fraud may have a variety of effects on organizations. For legal responsibility, a company that takes stolen money to pay for goods, for instance, joins a money-laundering network.

Additionally, businesses risk losing more than just the money transferred using P2P payment apps. Businesses may have to compensate the consumer while simultaneously losing items, depending on the sort of fraud.

Additionally, individuals implicated in several fraud cases run the possibility of being classified as high-risk merchants, which can result in excessive processing costs and penalties.

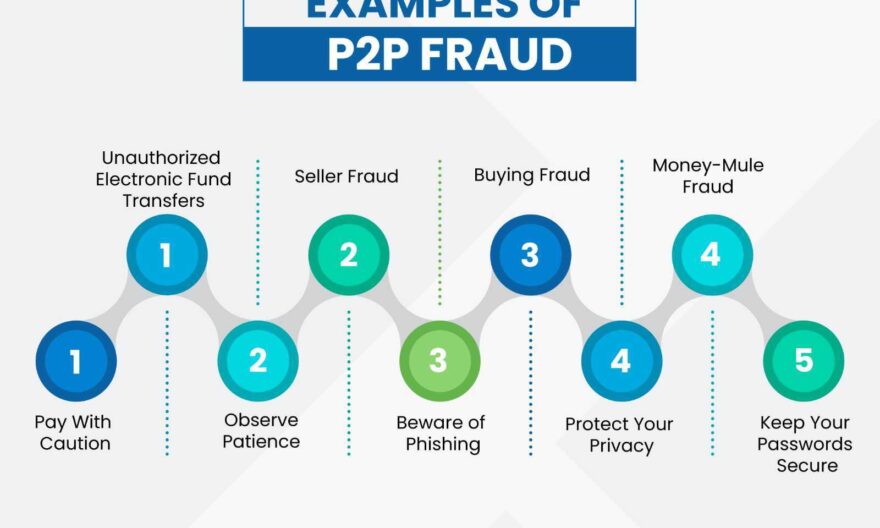

Examples of Common P2P Frauds

You may send money using several P2P apps with only one click or swipe. Due to the quickness, internet scammers can prey on consumers who aren’t paying attention.

Here are a few examples of common P2P frauds.

1. Unauthorized electronic fund transfers

This is an unauthorized electronic fund transfer if funds are sent from your account without authorization. A compromised card number, a stolen device, or a breached account may cause this fraud.

2. Seller fraud

There are several variations of this fraud. They could begin by offering tickets, or discounted goods. Anything might happen. However, they all share the same characteristic: It is doubtful that the purchased item will ever be delivered to your door.

We should always properly investigate new suppliers before making payments using P2P applications.

3. Buying fraud

The question “How can you get scammed if someone sends you money?” may come to mind. Though it may seem strange, it does occur.

These are called overpayment frauds. This occurs when a fraudster purchases something from a company but submits a cheque for more money than is owed. Scammers will demand the difference back into a P2P account. When the cheque bounces, the fraudster escapes with the money received through the P2P payment software. If the company has already shipped the items, those are also gone.

4. Money-mule fraud

The extra twist with these frauds is that getting caught up might land you in legal jeopardy as it’s a money-laundering fraud. The con may incorporate phony dating sites, home-based business opportunities, or false awards.

Scammers persuade victims to transmit money to a different individual after sending it to them. However, they won’t inform you that the money is stolen or that the justification for delivering it was invented to hide illicit behavior.

How to avoid P2P Fraud?

While scams and fraud may not be 100% avoidable, there are steps you can take to protect yourself. It’s important to be careful because once you send a payment, you may be unable to cancel it.

Here are a few tips that might help:

1. Pay with caution

Once you’ve submitted a transaction to another user, many P2P apps won’t allow you to cancel it. In light of this, refrain from asking or transferring money to someone you don’t know and trust.

Money travels swiftly when you utilize P2P programs. Money arrives quickly once you press the “send” button. To ensure that your money reaches where you intended, it is a good practice to double-check that you have the proper information.

2. Observe patience

When sending money over a P2P app, try not to hurry. It might be a warning sign if someone pressures you to take rapid action.

3. Beware of phishing

Posing as your bank or a P2P organization is one method fraudsters may attempt to access your account. They could make calls, text, or email attempts to contact you.

Stay away from providing personal information and clicking links. They could also say that you must download an additional app or provide them remote access to transfer money. Never grant a third-party remote access.

4. Protect your privacy

You can keep your information secure using social media by not disclosing things like your address, phone number, and other personal information. Additionally, refuse friend requests from strangers.

5. Keep your passwords secure

Use distinct passwords for websites and P2P applications. There are tools available that can help you if you’re concerned about remembering them all.

Conclusion

Peer-to-peer fraud is a serious issue in the current digital environment. Our society is becoming increasingly dependent on online platforms and payment options, greatly increasing the chances of fraud. The different aspects of peer-to-peer fraud, including its causes, effects, and potential solutions, have been clarified in this article.

Peer-to-peer fraud undermines trust in online platforms and transactions while threatening people’s financial security. Consumers must exercise caution and keep themselves informed about prevalent scam techniques. Organizations and online platforms must simultaneously invest in strong security measures and user education to identify and stop fraudulent actions.